Bank Loan vs. NBFC Loan: Which is Best for Your Business Growth?

Every entrepreneur faces a critical decision when it comes to financing: should you choose a bank loan or an NBFC loan (Non-Banking Financial Company)? Both have unique advantages and limitations. This guide from RupeeBoss will help you compare the two and choose the right fit for your business.

Banks: The Traditional Financial Pillar

Banks have been the backbone of business financing for decades, offering structured loan products such as:

Term Loans – Fixed-rate loans with predictable repayments.

Line of Credit – Flexible access to credit for working capital.

Working Capital Loans – Short-term solutions for daily cash flow needs.

Advantages of Bank Loans

Competitive Interest Rates – Lower rates due to higher reserves.

Long-Term Loans – Suitable for major investments and expansion.

Boosted Credibility – Improves business creditworthiness and trust.

Disadvantages of Bank Loans

Strict Eligibility Criteria – Requires strong credit and collateral.

Lengthy Application Process – Approval can take weeks.

Rigid Terms – Less flexibility compared to NBFCs.

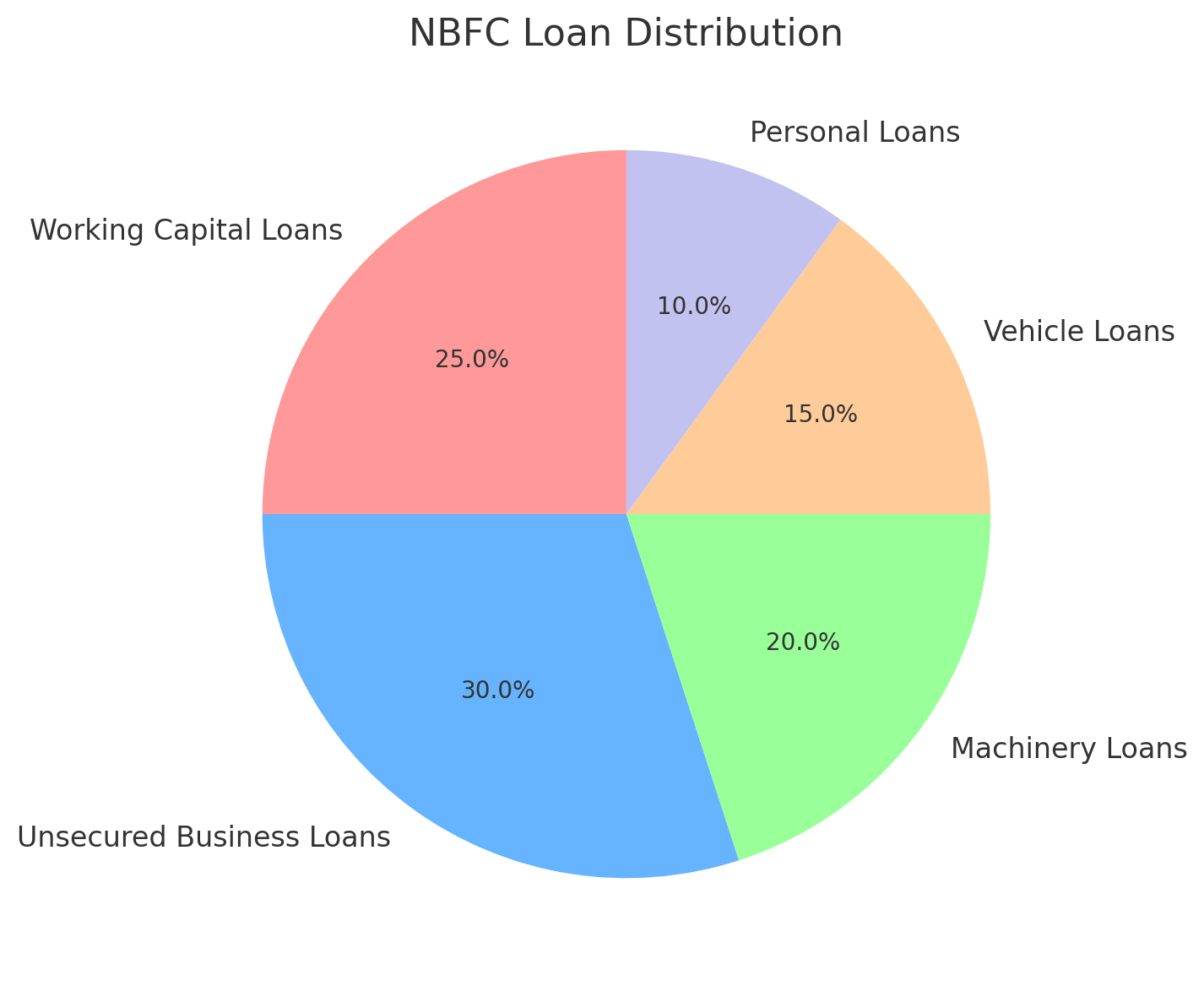

NBFCs: The Agile, Flexible Option

NBFCs are growing rapidly in India, offering faster, more adaptable funding solutions:

Small Business Loans – Quick financing for startups and SMEs.

Unsecured Business Loans – No collateral required.

Machinery & Equipment Loans – Boost production with asset financing.

Working Capital Loans – Maintain operations smoothly.

Inventory Loans – Buy stock ahead of seasonal demand.

Invoice Discounting – Convert pending invoices into instant cash.

Advantages of NBFC Loans

Faster Approvals – Ideal for urgent funding.

Flexible Eligibility – Focus on business potential, not just credit score.

Tailored Solutions – Products designed for specific business needs.

Disadvantages of NBFC Loans

Higher Interest Rates – Due to higher lending risk.

Shorter Repayment Periods – Less time to pay off.

Less Regulation – May concern risk-averse borrowers.

Bank Loans vs. NBFC Loans: Quick Comparison

| Feature | Bank Loans | NBFC Loans |

|---|---|---|

| Interest Rates | Lower | Higher |

| Approval Speed | Slow | Fast |

| Eligibility | Strict | Flexible |

| Loan Tenure | Long | Short |

| Flexibility | Low | High |

Choosing the Right Loan Partner: Key Considerations

Loan Amount – Banks suit larger amounts, NBFCs suit smaller or urgent needs.

Creditworthiness – Strong credit favors banks; weaker scores may still qualify with NBFCs.

Urgency – NBFCs provide quick access to funds.

Flexibility – NBFCs allow more customization of loan products.

👉 Explore tailored options with our Business Loans page.

For an overview of lending frameworks in India, check the RBI guidelines on NBFCs. For global insights, see Investopedia’s comparison of banks vs NBFCs.

RupeeBoss: Your Trusted Loan Partner

At RupeeBoss, we bridge the gap between banks and NBFCs by connecting you to the best loan offers in the market.

Wide lender network across India.

Fast, simplified application process.

Customized loan recommendations.

👉 Compare options today with our Bank vs NBFC Loan Comparison Guide.

Final Thoughts

Both banks and NBFCs have advantages depending on your loan size, urgency, and flexibility needs. The right choice depends on your business goals, financial stability, and repayment capacity.

Don’t let financing challenges slow you down. With RupeeBoss as your trusted partner, you can secure the right loan to fuel your business growth.